Best 6 Business Financing Services

Best 6 Business Financing Services

Last Updated July 2024

ADS

# 1

# 1 ranking out of 4

DESCRIPTION

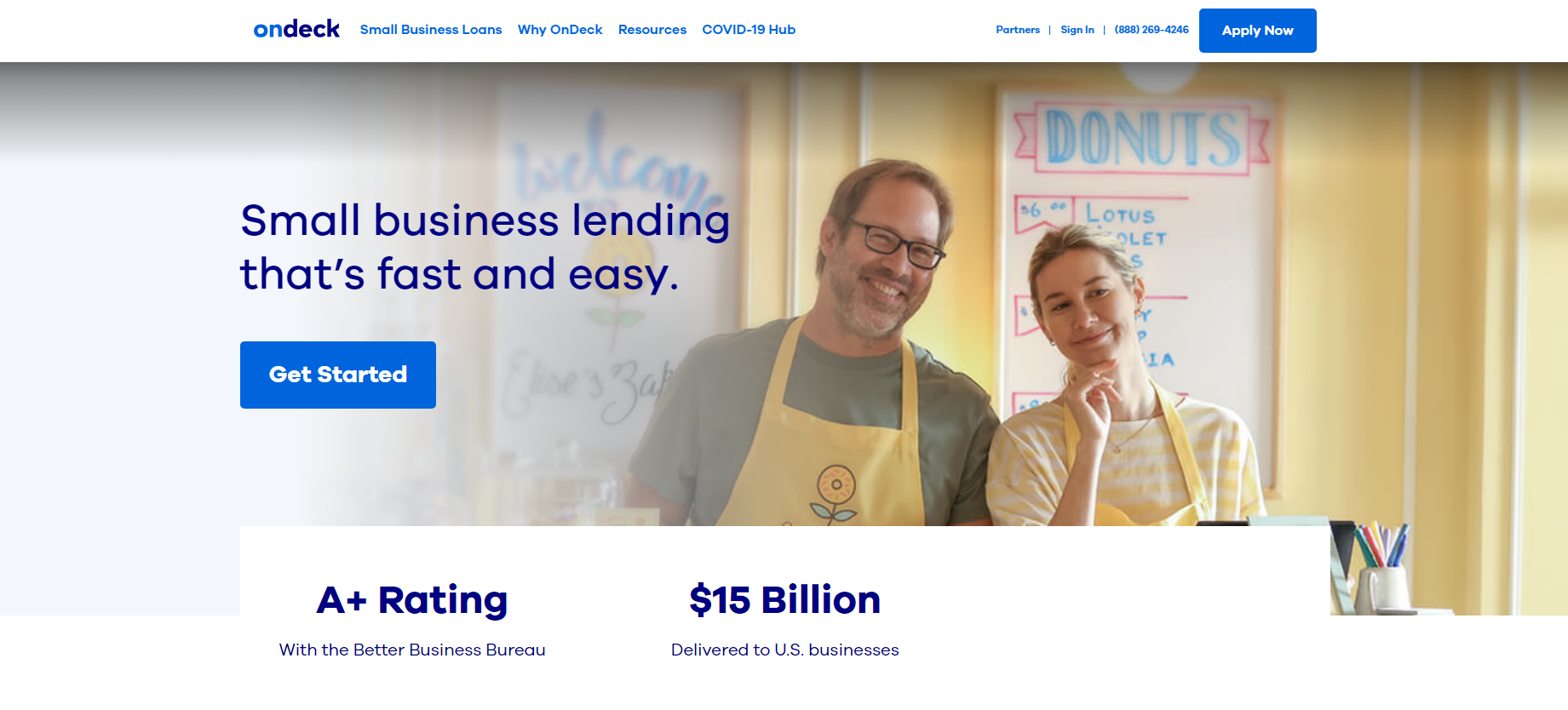

OnDeck is a business loans lender that excels in terms of fast loans, loyalty and a ton prepayment b...

FEATURES

- Best for - Fast funding, loyalty, prepayment benefits

- Interest rates - Starting at 35% Annual Percentage Rate (APR)

- Loan amount - Starts at $100,000 up to $250,000

- Funding period - Same day

- Credit score - 600

- Min revenue - $100,000 per year

- Min time in operation - 1 year

Pros

- Fast funding

- Prepayment benefits

- Short term loans

- Minimum credit score needed

# 2

# 2 ranking out of 4

DESCRIPTION

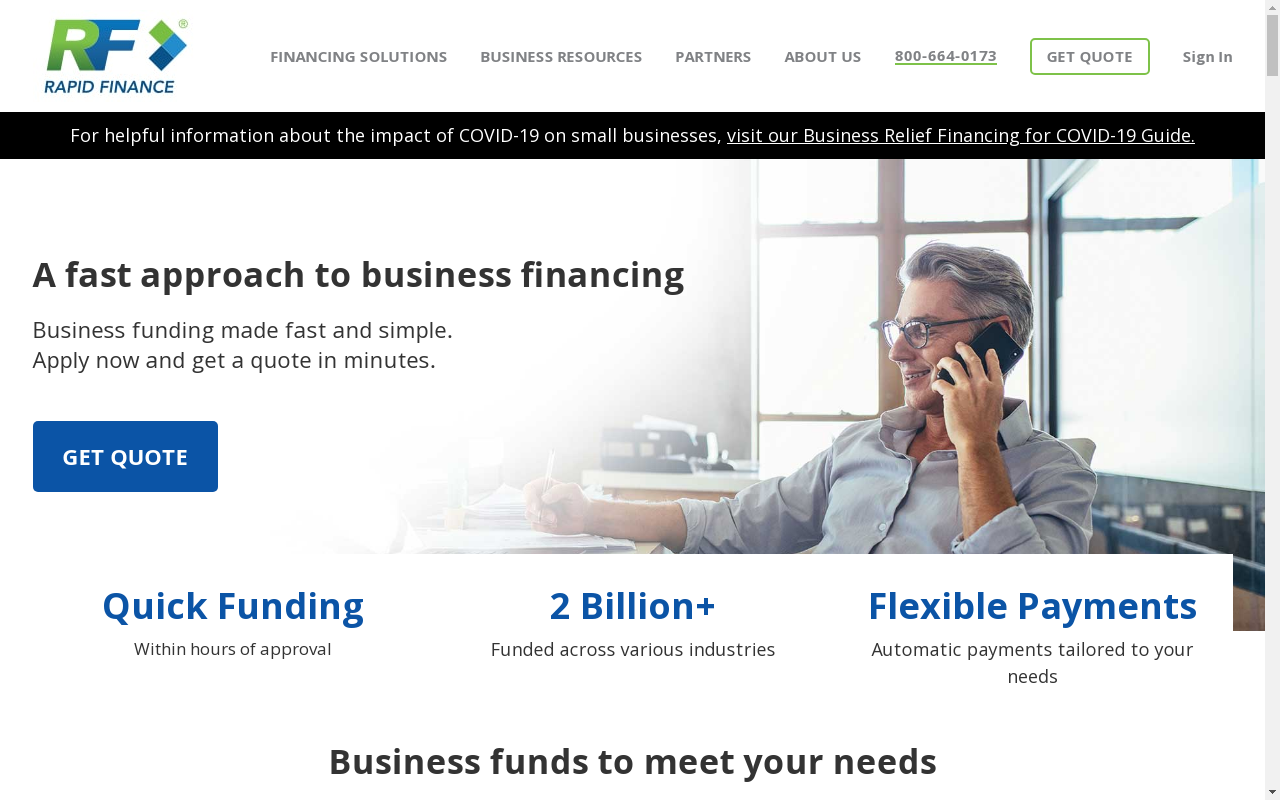

Rapid Finance is a tech-powered financial service that offers business loans to small and medium-siz...

FEATURES

- Best for - Merchant cash advances, fast funding, lines of credit, bridge loans, invoice factoring, asset-based loans, SBA loans, commercial and real estate loans

- Interest rates - Starting at 9% to 31% of the borrowing amount (STL)

- Loan amount - Starts at $5,000 up to $10 million

- Approval time - 1 business day

- Credit score - 550

- Min revenue - $50,000 per year

- Min time in operation - 2 years

Pros

- Fast funding

- Low credit score requirement

- Multiple term durations options

# 3

# 3 ranking out of 4

DESCRIPTION

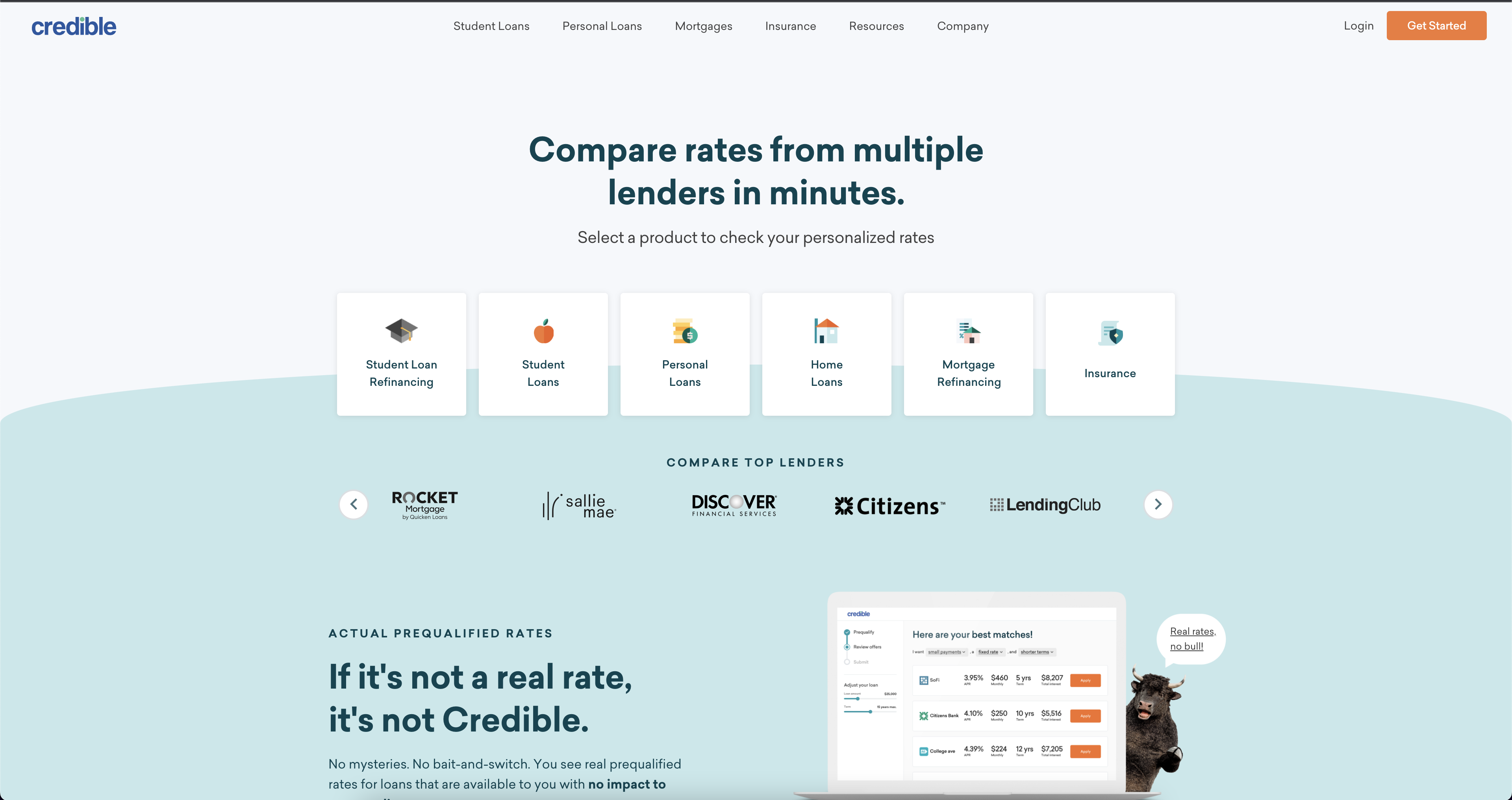

Credible is another excellent online marketplace for loan lenders with competitive, and tailored loa...

FEATURES

- Best for - Merchant cash advances, fast funding, lines of credit, bridge loans, invoice factoring, asset-based loans, SBA loans, commercial and real estate loans

Pros

- Free comparison services

- Easy to use

- 24/7 customer support

- Gives access to several loan lenders

- Provides prequalified rates without asking for your credit card information

- Has a strong security policy for the personal information you provide

- Vast educative knowledge database

# 4

# 4 ranking out of 4

DESCRIPTION

National funding is based in San Diego. This lending company has been operating since 1999, providin...

FEATURES

- APR Range - 15% - 30%

- Repayment Option - Daily, Weekly

- Funding Period - 24 Hours

- Credit Score - 500

- Best For - Small and Medium Sized Businesses

- Min Revenue - $100,,000 Anually

- Min Time In Operation - One Year Or More

- Loan Estimates - Up to $500,000

- Loan Term - Four To 60 Months

- Interest Rates - 15% - 35%

Pros

- Fast approvals and funding.

- Daily, weekly, or monthly payment options.

- Early payoff discounts.

- Low credit score requirements.

- Guaranteed lowest payment.

- No collateral is required.

- Easy application process.

- The application process doesn’t affect credit scores.

OnDeck

Rapid Finance

Credible

National Funding

Most businesses are now in the recovery phase, following the COVID-19 pandemic. As such, these businesses desperately need capital boosts for smooth operations. Therefore, if you’re in the market for a business loan, we have you covered. Considering all the financing options available today, comparing and arriving at the right business loan can be overwhelming. You can choose to go to traditional lenders like banks and credit unions for great deals, or you can borrow from online lenders for lower loan requirements. You get to decide which online lender gives the best policy in terms of loan terms, lines of credit, microloans, invoice financing and more.

Advertisers and marketers have flooded this internet with tons of Business Financing that claim to be the best. It can be hard to know which one is the best out of all those options. This article will give you a list of 4 Business Financing so you can make an educated decision before choosing what’s right for you.