Best Business Loans Services

Most businesses are now in the recovery phase, following the COVID-19 pandemic. As such, these businesses desperately need capital boosts for smooth operations. Therefore, if you’re in the market for a business loan, we have you covered. Considering all the financing options available today, comparing and arriving at the right business loan can be overwhelming. You can choose to go to traditional lenders like banks and credit unions for great deals, or you can borrow from online lenders for lower loan requirements. You get to decide which online lender gives the best policy in terms of loan terms, lines of credit, microloans, invoice financing and more.

Last Updated July 2024

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money

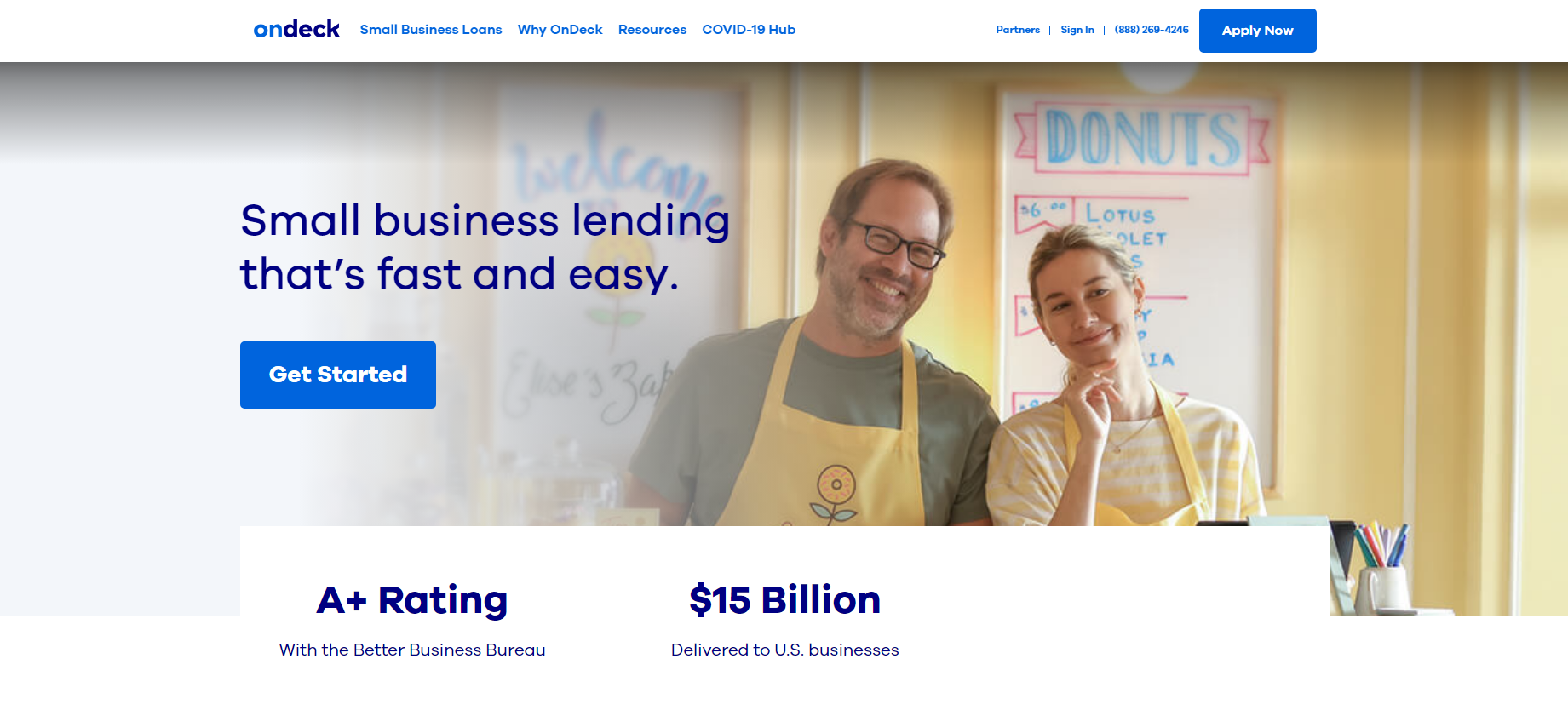

- Best For - Businesses requiring quick access to short-term loans and lines of credit

- Rating - 4.2/5

One of the notable advantages of OnDeck.com is their commitment to efficiency and speed. Their online application process is straightforward and can be completed in minutes, allowing business owners to quickly submit their loan requests without the need for extensive paperwork or long waiting times. This streamlined process enables entrepreneurs to access the funds they need within a short period, empowering them to address immediate business needs or take advantage of growth opportunities.

The company understands the unique challenges faced by small businesses, and their loan products are designed to meet these specific needs. OnDeck.com offers a variety of loan options, including term loans and lines of credit, providing businesses with the flexibility to choose the financing option that aligns with their cash flow requirements and growth plans. This versatility ensures that small business owners can access the capital they need to fuel their operations or invest in expansion.

OnDeck.com takes a personalized approach to customer service. Their knowledgeable and experienced team is readily available to guide business owners throughout the loan process, offering support and answering any questions or concerns. Their commitment to exceptional customer service sets them apart, providing entrepreneurs with the confidence and peace of mind needed when seeking financing solutions.

Pros

Cons

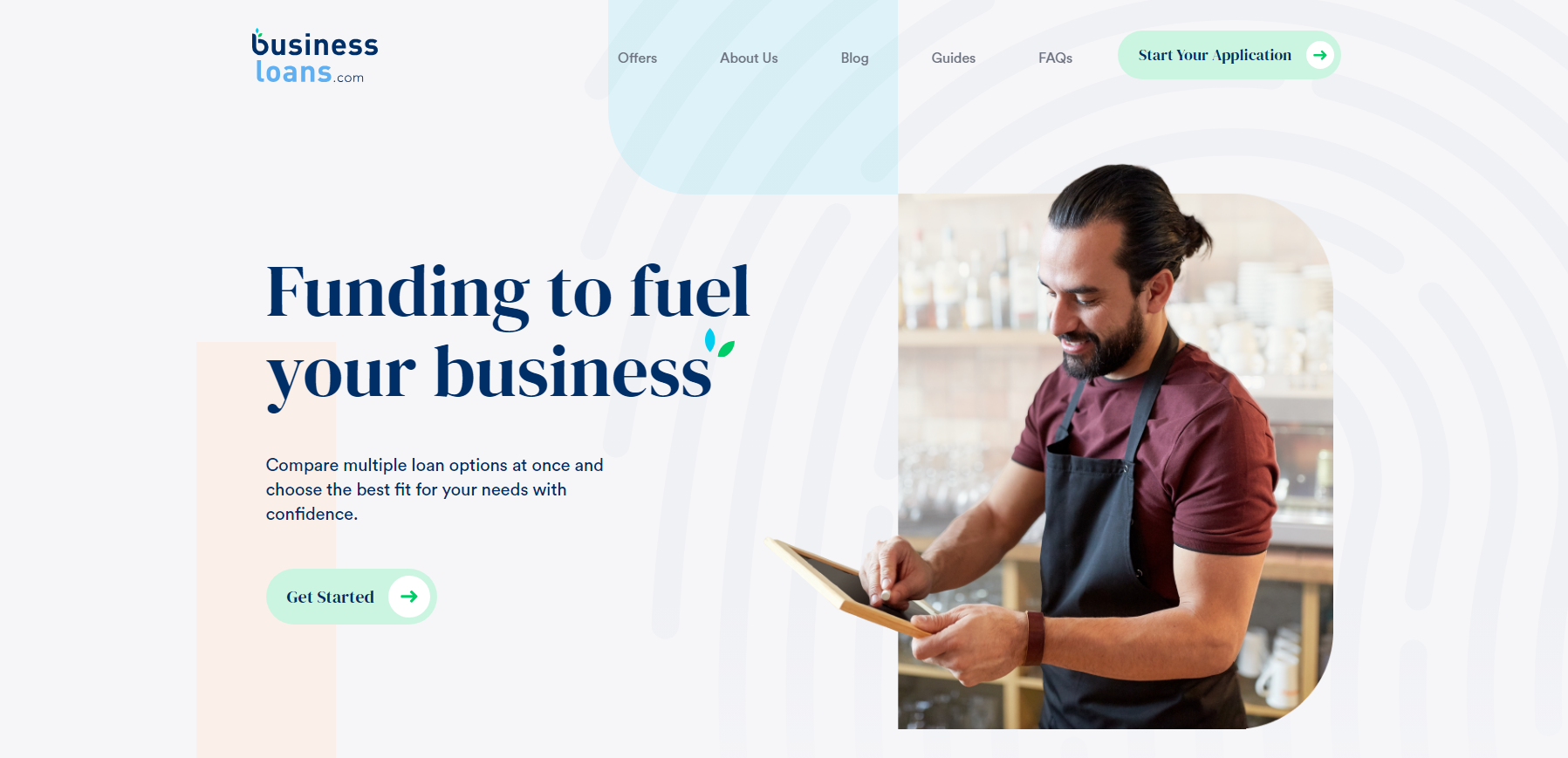

- Best For - Companies searching for a network of lenders to compare loan offers

- Rating - 4.1/5

BusinessLoans.com is a trusted platform that caters to companies seeking comprehensive business financing solutions. With their extensive network of lenders and personalized guidance, they aim to assist businesses in obtaining the funding they need to thrive and grow.

One of the notable advantages of BusinessLoans.com is their commitment to providing a wide range of business financing options. Whether it's traditional term loans, lines of credit, equipment financing, or invoice financing, they offer a variety of solutions to meet the diverse needs of businesses. This flexibility ensures that companies can find the right financing option that aligns with their specific requirements.

The company understands that each business is unique, and they offer personalized guidance throughout the financing process. Their experienced professionals work closely with companies to understand their goals, financial situation, and specific needs. This tailored approach allows businesses to make informed decisions and select the most suitable financing options for their operations.

BusinessLoans.com provides ongoing support and guidance to businesses, ensuring that they receive assistance at every step of the financing journey. Whether it's answering questions, addressing concerns, or providing advice, their dedicated team is committed to helping companies navigate the complex world of business financing.

Pros

Cons

- Best For - Entrepreneurs and businesses searching for diverse loan offers and financial resources.

- Rating - 4.1/5

Fundera has helped over 85,000 small businesses across the US. The online company has been in existence for over six years. They offer a wide variety of loans for different types of businesses. But that means the eligibility requirements also differ. You will be looking at quarterly, monthly, weekly or daily payments depending on the type of loan you take. They are not lenders per se; they help you find the best lender for your business.

They have comparison technologies to help you make better business financial decisions. For you to qualify for a loan, your business needs a 680 credit score. It's a bit higher than other competitors require, but they offer some of the best services. You will get invaluable financial advice, tools, information, and insight. Their high standard and strict criteria of choosing lenders will benefit you. You can rest assured your business will be getting funds from a legit lender.

Pros

Cons

- Best For - Small to mid-sized businesses seeking various loan options and financing solutions

- Rating - 4.2/5

Biz2credit is an excellent choice if you want an online market place that can help you get fast funding and don’t want to give a security. Biz2credit is not an actual business loan lender. The company uses a proprietary platform to get you the right funding source. Biz2credit boasts a fast process that allows businesses to register and get approvals in minutes. You also get funding the in under 24 hours.

Biz2credit is available to all models of small businesses and asks for minimum qualifications, low interest rates. They also charge low fees, but it varies with the loan lender you choose.

Pros

Cons

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money