Best Business Loans Services

Best Business Loans Services

Last Updated December 2025

DESCRIPTION

You may benefit from SBG Funding’s business loan services if your company needs quick, reliable capi...

FEATURES

- Best For - Small and midsize businesses seeking flexible and fast-access funding

- Rating - 4.9/5

Pros

- Fast approvals and streamlined application process

- Customized funding plans tailored to business needs

- Wide range of financing products available

- Transparent pricing with clear terms

- Ongoing support from knowledgeable funding specialists

DESCRIPTION

You may benefit from CapFront Funding’s business loan services if you need fast, reliable financing...

FEATURES

- Best For - Businesses seeking quick, hassle-free access to working capital

- Rating - 4.5/5

Pros

- Quick approvals with minimal documentation

- Wide range of financing options for different business needs

- Flexible repayment terms tailored to cash flow

- Clear and transparent fee structure

- Ongoing support from knowledgeable funding specialists

DESCRIPTION

BusinessLoans.com is a trusted platform that caters to companies seeking comprehensive business fina...

FEATURES

- Best For - Companies searching for a network of lenders to compare loan offers

- Rating - 4.85/5

Pros

- Wide range of business financing options to meet diverse needs

- Personalized guidance tailored to individual businesses

- Ongoing support and assistance throughout the financing process

- Access to a network of lenders for increased funding opportunities

- Comprehensive solutions for various financing needs

DESCRIPTION

Fora Financial offers tailored business loans designed to meet the unique cash flow needs of small a...

FEATURES

- Best For - Businesses earning at least $20,000 in monthly revenue, operating for 6+ months, with a minimum credit score of 570+

- Rating - 4.9/5

Pros

- Trusted direct funder with over 17 years of industry experience and a strong reputation

- Approvals in as little as 4 hours; funding available within 24 hours

- Flexible funding solutions up to $1.5 million, tailored to business needs

- Simple online application with minimal documentation

- Dedicated customer support to assist throughout the process

DESCRIPTION

Fundera has helped over 85,000 small businesses across the US. The online company has been in existe...

FEATURES

- Best For - Entrepreneurs and businesses searching for diverse loan offers and financial resources.

- Rating - 4.7/5

Pros

- Suitable for different business purposes

- They analyze lenders thoroughly

- Can finance larger investments

- Easy application process

- Transparent terms and fees

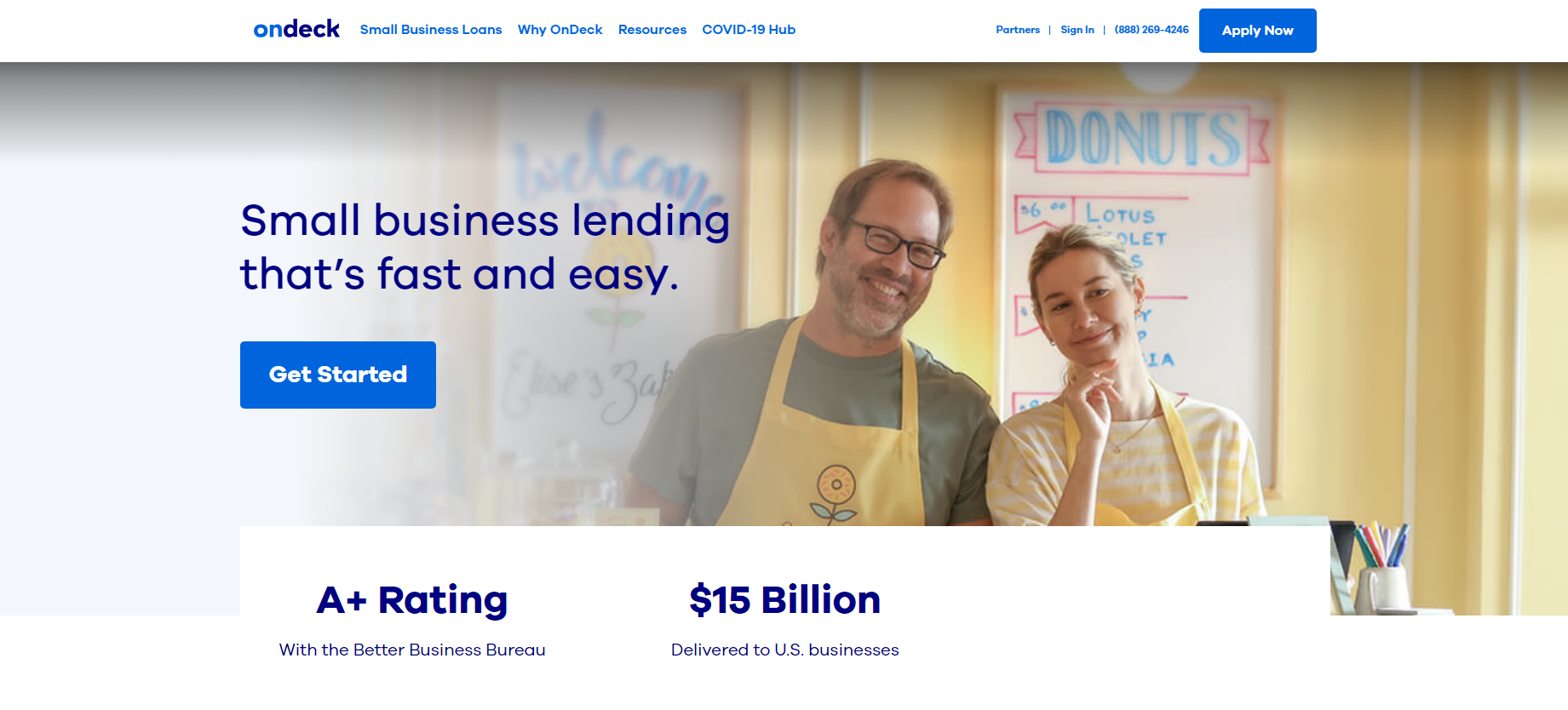

DESCRIPTION

One of the notable advantages of OnDeck.com is their commitment to efficiency and speed. Their onli...

FEATURES

- Best For - Businesses requiring quick access to short-term loans and lines of credit

- Rating - 4.2/5

Pros

- Streamlined and efficient online application process

- Fast funding to address immediate business needs

- Flexible loan options tailored to small businesses

- Dedicated customer support and guidance

- Transparent terms and competitive interest rates

DESCRIPTION

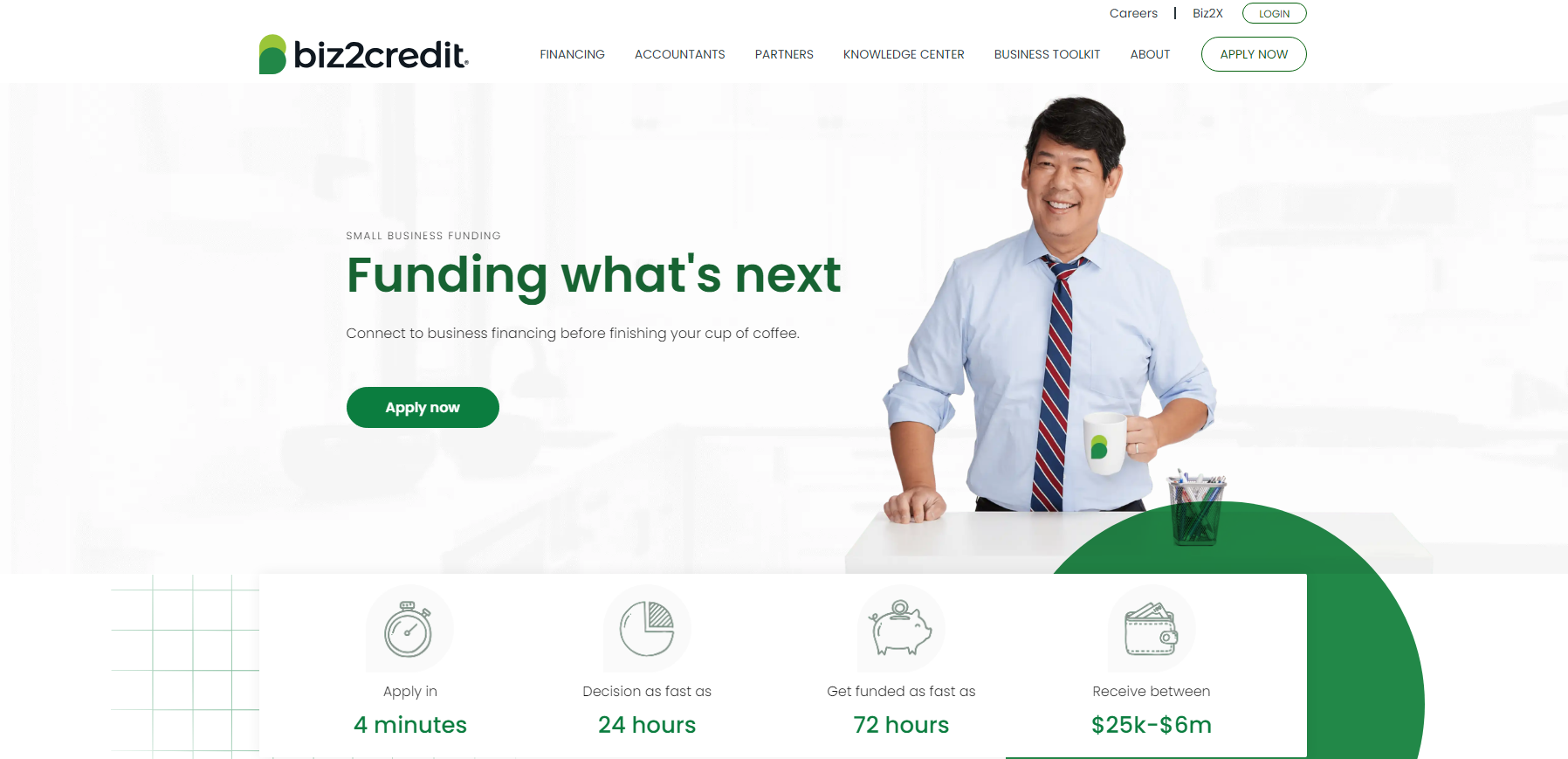

Biz2credit is an excellent choice if you want an online market place that can help you get fast fund...

FEATURES

- Best For - Small to mid-sized businesses seeking various loan options and financing solutions

- Rating - 4.2/5

Pros

- Zero application fees

- Funding in under 24 hours

- Get unsecured loans

- Merchant cash advances

Most businesses are now in the recovery phase, following the COVID-19 pandemic. As such, these businesses desperately need capital boosts for smooth operations. Therefore, if you’re in the market for a business loan, we have you covered. Considering all the financing options available today, comparing and arriving at the right business loan can be overwhelming. You can choose to go to traditional lenders like banks and credit unions for great deals, or you can borrow from online lenders for lower loan requirements. You get to decide which online lender gives the best policy in terms of loan terms, lines of credit, microloans, invoice financing and more.