Best Credit Help Services

Credit Help Services systems can benefit your business in many ways, with a number of important features and functions. With COVID-19 constantly changing the rules of the game, the features offered by the latest Credit Help Services systems can keep you ahead of the competition, so look out for special New Year deals and make sure your business is ready for whatever Credit Help Services has in store.

Last Updated July 2024

Lexington Law

The Credit People

NationalDebt Relief

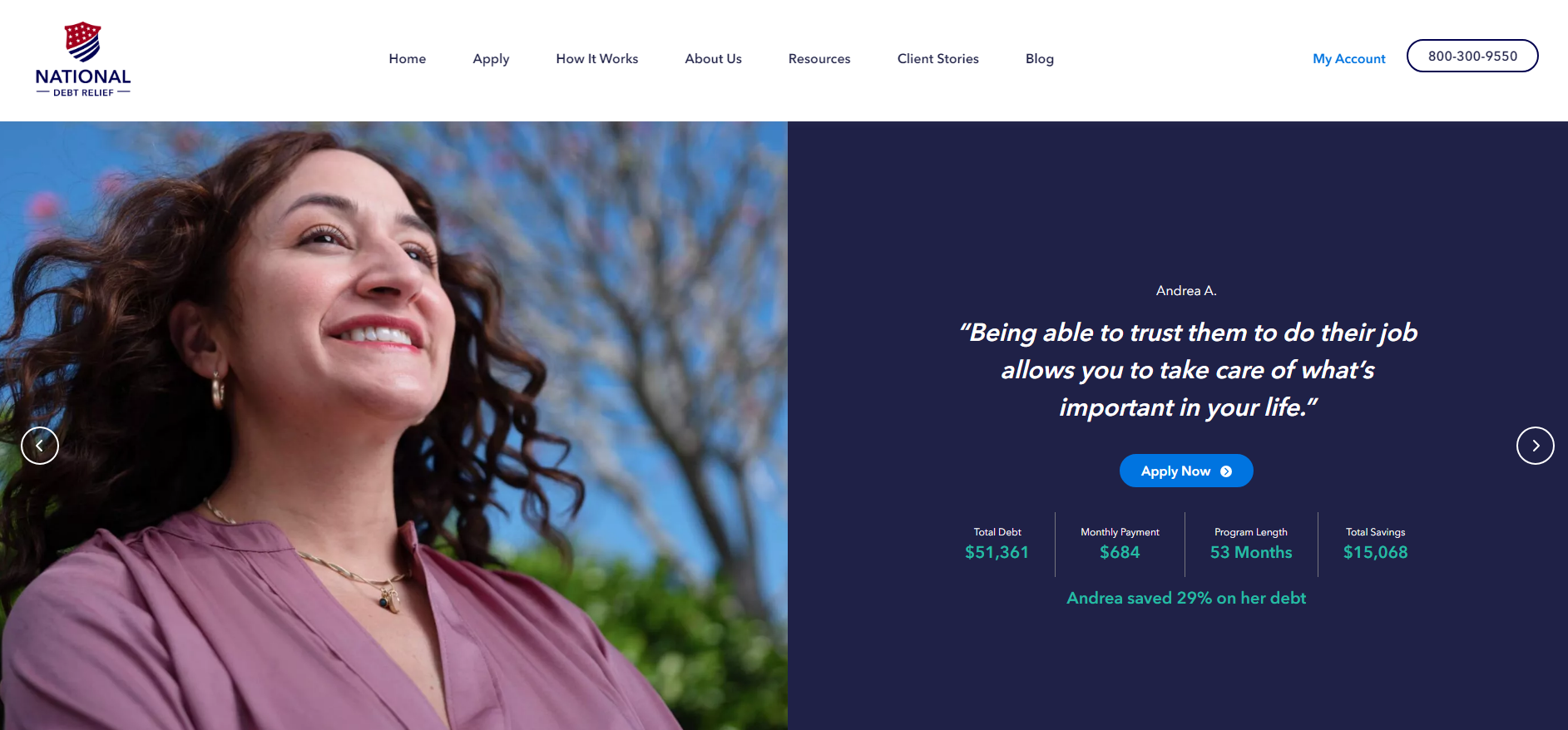

The Credit Pros

Safeport

Nevly

Sky Blue

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money

- Best For - Individuals seeking professional assistance in credit repair and improvement

- Rating - 5/5

Lexington Law focuses on providing comprehensive credit help services aimed at repairing and improving clients' credit scores. With a team of experienced lawyers and paralegals, Lexington Law works diligently to dispute inaccurate or unfair negative items on credit reports, including late payments, collections, and bankruptcies.

Pros

Cons

- Best For - Cost-effective credit repair services

- Rating - 4.2/5

The company stands out from the competition due to its inexpensive initiation costs. Unlike competing credit repair businesses, The Credit People only charge $19 to sign up and see your credit report. Once your account is set up, you can pay $79 each month until you reach your goals or pay $419 upfront for a six-month plan.

Using The Credit People's user-friendly online dashboard, you can keep tabs on any changes made to your credit report or credit score by any of the three major credit reporting agencies. Similarly, you may contact customer care if you have any queries or want to keep tabs on any pending issues.

Pros

Cons

- Best For - Individuals seeking effective credit help services and debt settlement

- Rating - 4.2/5

You may benefit from National Debt Relief's credit help services if you are facing challenges with overwhelming debt. This credit assistance firm specializes in efficient debt settlement, employing experienced professionals to navigate the complexities of credit challenges. With a focus on assisting individuals in financial distress, National Debt Relief brings over a decade of expertise in debt settlement and consumer advocacy.

Financial difficulties often arise from accumulated debt, and National Debt Relief's team understands the intricacies of negotiating with creditors to achieve favorable settlements. They work tirelessly to help you regain control of your finances by customizing plans to suit your unique needs.

Pros

Cons

- Best For - Individuals seeking top-notch credit repair services

- Rating - 4.9/5

You may benefit from The Credit Pros' credit repair services if you face challenges in improving a low credit score. This credit repair firm employs skilled professionals to contest credit score inaccuracies effectively. With over 20 years of combined expertise in credit restoration and consumer advocacy, these experts are equipped to assist you in navigating your financial situation.

The team at The Credit Pros diligently examines your credit report, identifies errors, and disputes any unfavorable entries with the credit reporting agencies and your creditors, aiming to enhance your credit score.

Pros

Cons

- Best For - Individuals seeking professional credit repair and debt settlement services

- Rating - 4.8/5

SafePort Law's credit repair services cater to individuals facing challenges with a low credit score. With an admirable rating on Better Business Bureau, this company distinguishes itself by offering top-tier legal counsel and credit repair expertise. The seasoned legal professionals, boasting over 15 years of experience, diligently work to rectify credit score mistakes and advocate for consumers.

Pros

Cons

- Best For - Individuals seeking professional credit repair and financial guidance

- Rating - 4/5

Nevly provides valuable credit help services for individuals looking to repair their credit and gain financial independence. With experienced professionals, tailored credit repair plans, and a focus on financial education and support, they offer a solid path to improving your credit and overall financial health.

Navigating the complexities of credit repair and financial management can be challenging, but Nevly offers comprehensive credit help services to assist you on your journey to better credit and financial stability.

They offer a range of benefits for those seeking to improve their credit and financial well-being.

Pros

Cons

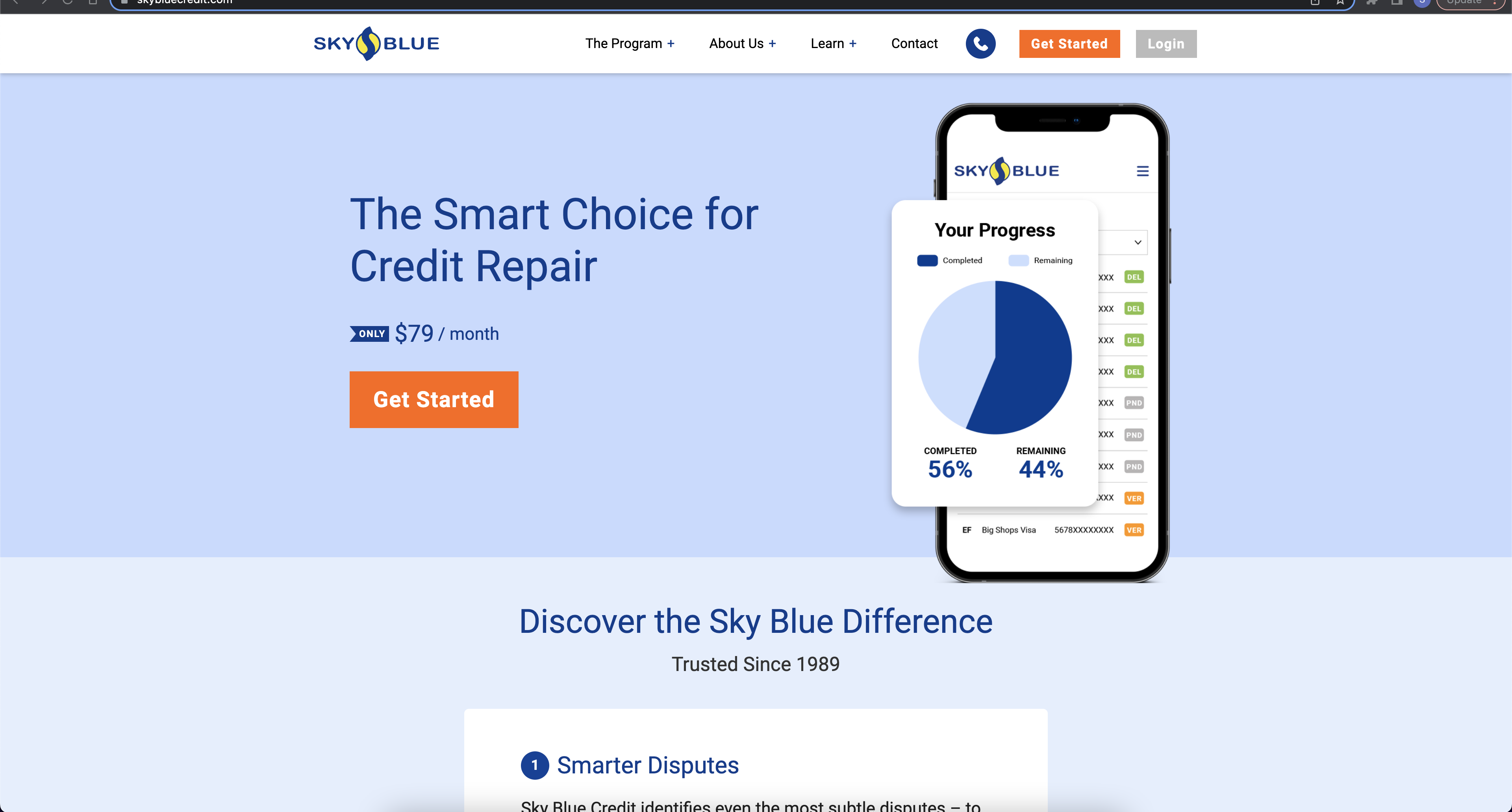

- Best For - Affordable credit repair options

- Rating - 4.0/5

Sky Blue Credit help has been in business for over thirty years. The company offers a unique and affordable single credit-help service plan that entails all the necessary support to clean up a credit report.

Sky Blue service packages do not require upgrades to expensive plans. The company charges a one-time set-up fee of $79 and a monthly subscription of $79, giving clients access to detailed credit-report analysis and customized dispute letters.

Sky Blue offers a 50% discount to one member of a couple that has subscribed together. The company has a 90-days refund policy. Clients unsatisfied with the services provided can claim a refund within ninety days.

Sky Blue allows customers to pause their subscriptions online. You will not get charged the monthly subscription fees during the paused period. The flexibility of pausing and resuming accounts helps clients save on frequent start-up fees.

Pros

Cons

Lexington Law

The Credit People

NationalDebt Relief

The Credit Pros

Safeport

Nevly

Sky Blue

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money