Best Payroll Services

Making payments to your employees and freelancers can be a daunting process if you don’t have the convenience of a Payroll service. Implying that these services offer seamless techniques that employers use to calculate, schedule, make payments, and send needed tax forms to its employers and freelancers. However, Payroll systems can be somewhat complex and confusing to configure on your own, especially if you have a bigger number of employees. Please read our short expert reviews of each payroll service below to understand why we think our top 10 picks are best to work with.

Last Updated October 2024

Gusto

Paychex

Software Advice Payroll

Patriot

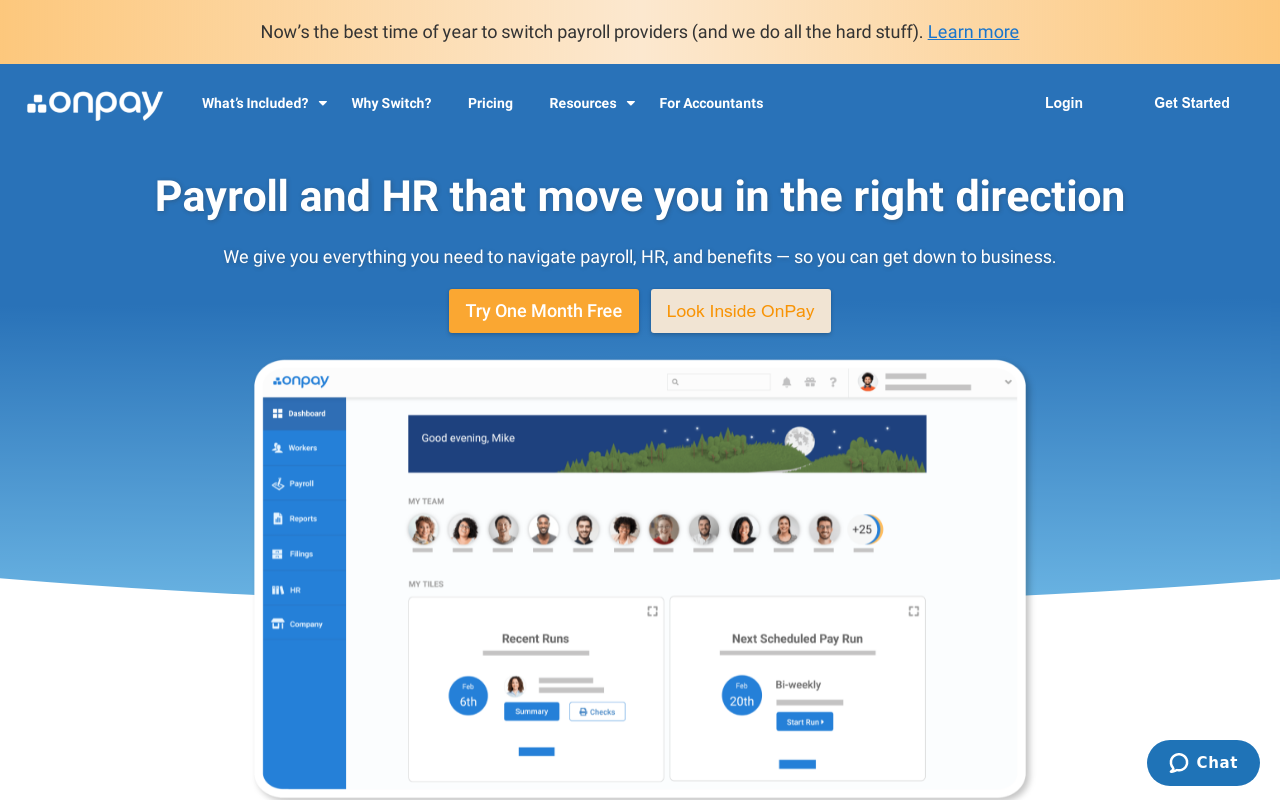

Onpay

Rippling

ADP

QuickBooks

Deluxe

Roll by ADP

Zenefits

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money

- Best For - Small to medium-sized businesses seeking an intuitive, all-in-one platform for payroll, benefits, and HR management

- Rating - 4.9/5

Gusto is a leading provider of payroll, benefits, and HR services, recognized for its user-friendly, all-in-one platform that simplifies complex administrative tasks for over 300,000 businesses across the United States. Originally launched as ZenPayroll in 2012, Gusto has evolved into a comprehensive solution that automates the entire payroll process, including wage calculations, tax filings, and employee payments, making it an ideal choice for businesses looking to streamline their operations. In addition to payroll, Gusto offers integrated benefits management, such as health insurance, retirement plans, workers' compensation, and time tracking, enabling businesses to handle all HR tasks from a single, centralized platform.

Gusto's commitment to making HR and payroll tasks accessible and efficient is evident in its intuitive interface, which requires minimal training to navigate. The platform is cloud-based, allowing business owners, HR managers, and employees to access and manage payroll, benefits, and other HR tasks from anywhere with ease. Gusto emphasizes treating employees as valued individuals, offering benefits and tools that enhance employee satisfaction and retention, such as automated onboarding, employee surveys, and performance management features.

Gusto offers three primary pricing plans—Simple, Plus, and Premium—each tailored to meet the diverse needs of businesses at different stages of growth. The Simple plan provides essential payroll features at an affordable price, making it suitable for small businesses just starting out. The Plus plan expands on this with additional tools for managing growing teams, including full-service payroll across multiple states, time tracking, and next-day direct deposit. The Premium plan, designed for larger or more complex businesses, offers dedicated support, advanced HR tools, and customizable options, including access to certified HR professionals and strategic guidance. Custom pricing is available for businesses with unique needs, ensuring that Gusto remains flexible and scalable as companies grow.

One of Gusto’s standout features is its seamless integration with popular accounting, time tracking, and productivity tools like QuickBooks, Xero, Clover, and Google Workspace, further streamlining administrative tasks and enhancing productivity. Gusto's platform supports compliance by automatically handling local, state, and federal tax filings, and it provides clear, detailed reports that give business owners valuable insights into their operations. The platform’s robust capabilities, combined with its focus on user experience and employee well-being, make Gusto a comprehensive solution for businesses seeking to improve their payroll, benefits, and HR processes.

Pros

Cons

- Best For - Comprehensive payroll services with a focus on compliance

- Rating - 4.3/5

Paychex is an American service that offers human resource, payroll and benefits for small to medium size businesses. As such, you stand to benefit the most if your business has an approximate 50 employees. Furthermore, the company also offers plan for every business size. For instance, the Paychex Flex plan that targets SMBs, allows you to access and update the database via mobile or desktop apps. You can also configure automated actions and run seamless payroll payments. The main highlight, Paychex allows you to delegate input data to you employees.

Paychex can also calculate, pay, and file your taxes. This is automated action ensures that you don’t have any compliance issues with the federal authorities. Thanks to Paychex, you can also pay your employees through direct deposits, pay cards, or paper checks. Finally, using Paychex, guarantees benefits like onboarding, HR analytics, calendar view, and more.

Pros

Cons

- Best For - Businesses seeking to streamline their payroll processes efficiently

- Rating - 4.6/5

In the complex world of payroll management, SoftwareAdvice.com emerges as a crucial ally for businesses aiming to optimize their payroll operations. By offering a tailored advisory service, SoftwareAdvice.com significantly simplifies the process of selecting the right payroll software, matching businesses with solutions that align with their specific requirements, including goals, needs, and budget constraints. With an impressive selection of 1,414 payroll products across 10 distinct categories, they ensure a fit for every business size and type.

The journey to finding your ideal payroll solution begins with a concise consultation to gather insights into your business objectives. Shortly after, you'll receive a curated list of payroll software recommendations. This streamlined approach not only expedites the selection process but also positions businesses to make well-informed decisions, backed by expert guidance and comprehensive market insights.

Pros

Cons

- Best For - Affordable and easy-to-use payroll solutions

- Rating - 4.3/5

Patriot Software is the ultimate tool to track your business expenses and handle payrolls. It's easy to set up and doesn't have a long learning curve. User-friendliness is what most people are after. They offer affordable services that suit businesses on a budget. You will get tax filing and tax deposit reports on top of the payroll details. Employees are invaluable assets; that is why payrolls need to be a priority. Luckily Patriot has all the features your business needs.

You can take advantage of a free trial and test run all the features before you start the month-to-month payments. There are billing and invoicing tools that include automated payment reminders, and you can create custom invoice templates. Accounting reports will help you make better business financial decisions. Patriot will break down year-to-date details. You can download these reports either with CSV or PDF files. You will access third-party integrations like Plaid, CardConnect, and QuickBooks.

Pros

Cons

- Best For - User-friendly and affordable payroll processing

- Rating - 4.3/5

Onpay is an excellent choice if you want a service that offers a user-friendly interface and an easy-to customize payroll platform. The service also suits small businesses that are looking to expand as well. Furthermore, Onpay gives surprisingly in-depth features that allow you to streamline all payroll requirements hassle-free. For instance, you can download W2s for employees and 1099 forms for contractors as well. There’s also automated tax filing, payroll payments, workers’ compensation, health insurance and other HR benefits.

What’s more, Onpay offers impeccable integration capabilities that lets you sync with time trackers, and link accounting software to your payroll system. Overall, the major highlight is the impeccable customer support you get from Onpay. The company has actual humans on the support end alongside a vast knowledge base system.

Pros

Cons

- Best For - Integrated payroll, HR, and IT management

- Rating - 4.2/5

Rippling is another best choice for business payroll services. The company identifies with simplicity and it process seamless HR, IT and Payroll service delivery. Rippling’s payroll service runs syncs perfectly with several employee benefits programs and supports payments via direct deposits, and checks. The best part, you can enable the one-click 90-second mass payments to 1000 plus employees.

In terms of its pricing, the plans starts at $8 a month per user. However, you’re free to ask for customizable plans for a fair price.

Pros

Cons

- Best For - Industry-leading payroll solutions and HR support

- Rating - 4.4/5

Automated Data Processing (ADP) is an excellent choice if you require a powerful payroll service that can accommodate small, medium and enterprise-level businesses. ADP has a long standing reputation and trust for being the oldest payroll service in the industry. The company offers a complete range of payroll services, HR benefits, accounting and time management. Furthermore, ADP also offers other useful benefits like tax compliance, HR guidance, reporting, and more.

ADP is designed to automatically calculate tax liability, withhold and pay taxes for your business operations. You can also bank on ADP to handle reports, including W-2s and 1099s. Additionally, ADP is also available in more than 140 countries around that world – a big plus over its competitors.

Pros

Cons

- Best For - Integrated payroll and accounting for small businesses

- Rating - 4.4/5

QuickBooks well known for accounting services, has recently entered the payroll industry. The company now offers unique payroll services that integrates effortlessly with all major accounting platforms – allowing for an all-round service.

QuickBooks stands out with its tax filing service. The company enjoys a high reputation of offering a year-around tax filing that includes, automatic filing, handles deductions, creates custom categories and tracks sales tax for your product sales. Thanks to this, you can concentrate on other business operation without worrying about tax compliance issues.

Pros

Cons

- Best For - Customized payroll and HR solutions

- Rating - 4.3/5

Deluxe is a century old brand that offers excellent payroll services. The award-winning company offers payroll services to a massive customer base of over 5 million businesses. Deluxe’s success is attributed to its comprehensive HR and payroll services in the industry. Active customers get access to useful tools like tax filing, employee self-service, efficient onboarding procedures, workers’ compensation administration and more.

Deluxe also accepts multiple payment options like direct deposits, paper checks and pay cards. Deluxe also gives you the freedom to make regular payment for automated payroll processing, no-questions-asked. Moreover, employees get access to their own payroll reports that entail expenses, deductions, and paid off days. Deluxe also handles your HR services and offers various benefits like online enrollment and custom HR document management.

Pros

Cons

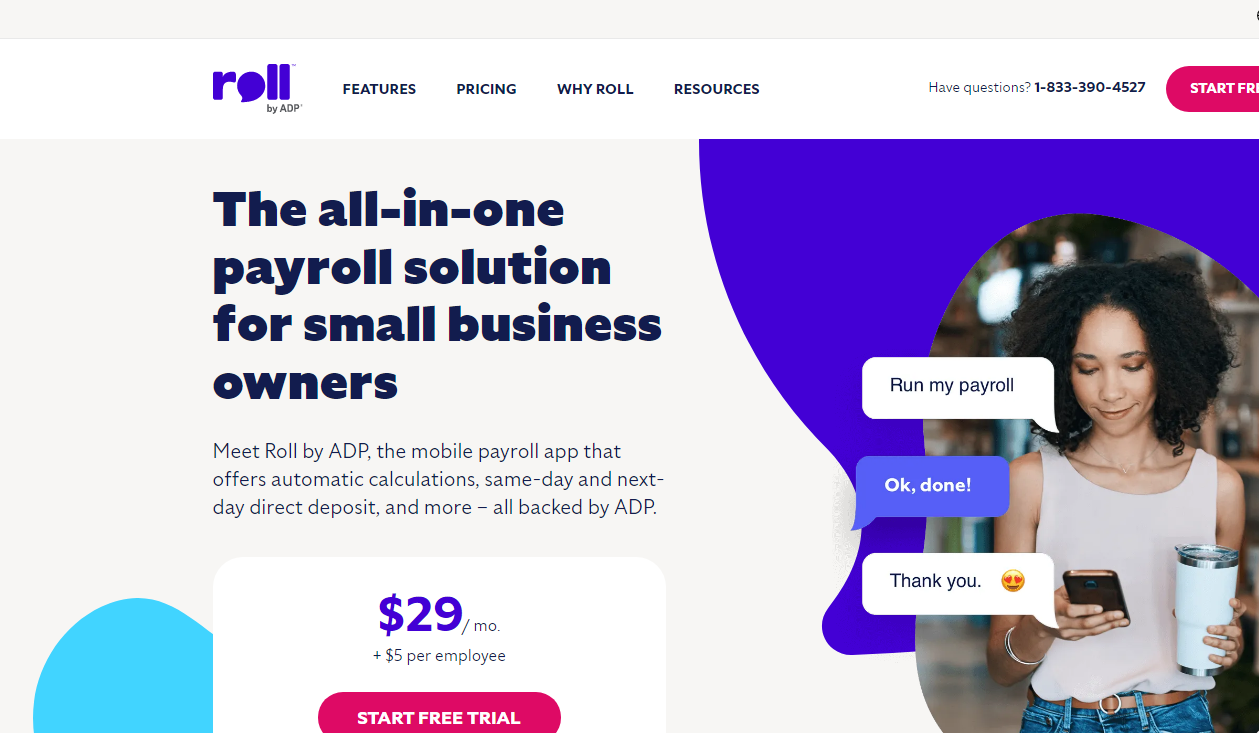

- Best For - Scalable payroll and HR management

- Rating - 4.4/5

Roll by ADP is a payroll program that operates through chat and is compatible with iOS and Android devices. Its mobile operating system enables handling payments for staff and independent contractors with only a few text messages. Features and functions such as training, analytics and employee self-service are also included.

The platform is simple to use for those who are comfortable with technology. Roll by ADP features a predefined set of chat commands for handling common human resources and payroll operations. Similarly, its sophisticated AI can understand your directions even if you do not use those specific words. Depending on your needs, it responds to a wide range of chat instructions and offers various choices such as payment methods and earning types.

Pros

Cons

- Best For - Integrated payroll and HR solutions for businesses

- Rating - 4.3/5

Zenefits is another simplified payroll service that offers employee self-service for a more intuitive experience. Noteworthy, Zenefits has an impressive employee benefits program that offers services like 401k retirement funds, FSA and HAS accounts, commuter benefits, as well as medical covers for dental, vision and disability insurance.

Moreover, Zenefits also offers a solid payroll service that guarantees straightforward payments. You also get exciting features like unlimited pay runs, contractor payments, garnishments, reporting and tips. Finally, Zenefits provides mobiles apps that allow you access the service from anywhere.

Pros

Cons

Gusto

Paychex

Software Advice Payroll

Patriot

Onpay

Rippling

ADP

QuickBooks

Deluxe

Roll by ADP

Zenefits

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money