Sofi Savings accounts

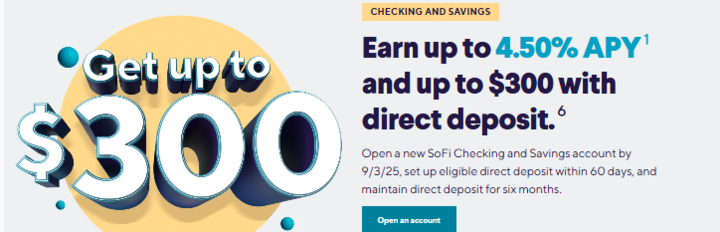

You may benefit from the SoFi Savings Account if you want to grow your money faster without worrying about fees. SoFi Bank, N.A. offers up to 3.80% APY² on savings balances (including Vaults) when you set up qualifying direct deposit or meet the required deposit threshold during the 30-day Evaluation Period.

Sofi Savings accounts Review

You may benefit from the SoFi Savings Account if you want to grow your money faster without worrying about fees. SoFi Bank, N.A. offers up to 3.80% APY² on savings balances (including Vaults) when you set up qualifying direct deposit or meet the required deposit threshold during the 30-day Evaluation Period.

There are no minimum balance requirements, and your money is FDIC insured up to $250,000, with access to up to $3M in additional FDIC insurance through the SoFi Insured Deposit Program⁴. Users can manage savings goals through Vaults and monitor their interest growth via the SoFi app. Disclosures 2. APY accurate as of 1/24/25 and subject to change. Requires eligible direct deposit or $5,000+ in qualifying deposits during the 30-day Evaluation Period. 3. SoFi Bank does not charge account, service, or maintenance fees. Outgoing wire fees may apply. 4. SoFi Bank is a member FDIC and provides insurance up to $250,000. Additional FDIC insurance up to $3M is available via the SoFi Insured Deposit Program

Pros

Cons

Best Business Savings Accounts Providers